NEW DATA THIS MONTH: 2025 Q2 Retail Sales Report

MUSIC TRADES DATA SUBSCRIPTIONS

Sign Up For Annual Data Packages and Access 100+ Years of Back Issues

New data subscription options deliver a year's worth of Music Trades reports bundled at a cost-effective rate. Subscribe to get the newest reports the moment they're released.

JUST RELEASED 2025 Top 200 Retail Sales Ranking Report

Economic Headwinds And A Post COVID Hangover Stress The Top 200

The Numbers Illustrate, 2024 Was A Challenge For All Music Products Retailers

By the numbers, 2024 was a down year on every front for the 200 largest U.S. based music products retailers. Estimated gross revenues for the group declined 4% to $6.63 billion, compared to $6.90 billion in 2023, the employee count trended down 6.2% to 21,140 versus 22,830 in 2023 and the number of storefronts declined 4.5% to 1,116 versus 1,168. The 54 retailers on the roster who posted sales gains for the year were in a distinct minority. 134 of their counterparts saw declines ranging from 1% to 40% with the remaining 12 posting .......

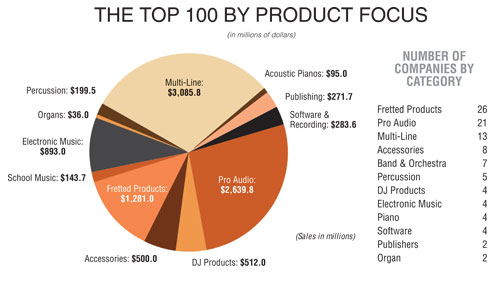

Top 100 North American Manufacturer Sales Ranking

Rising prices for essentials crimp discretionary budgets for things like music products

Aggregate revenues for the 100 largest North American-based music products suppliers were essentially flat at $10.3 billion in 2024. The employee count was similarly stable at approximately 20,700. Of the 100 companies ranked, 51 posted sales declines, twelve experienced unchanged sales, and the remaining 37 saw revenue gains. There’s a unique story behind the results of every enterprise on the list, yet three macro trends go a long way towards explaining the industry’s stagnant revenues. Foremost is the lingering impact of COVID era lock-downs that prompted millions .…..

JUST RELEASED 2nd Quarter Retail Sales Report

Sales begin to stabilize as retailers brace for impact of tariffs that are now

pushing up prices and driving heightened competition

“Tariffs are killing this business.” “Unsure what will happen when Tariffs take hold!!!” “Tariffs are just another nail in the coffin for independent music stores.” These comments from retailers express the widespread anxiety about the real and perceived impact of tariffs, which have been in place since May 14 for many of the countries supplying music products. Despite the looming challenge of escalating prices on imported goods, the industry posted a respectable quarter with sales essentially flat: down just.......

JUST RELEASED The 2025 Market Report For Musical Instrument & Audio Accessories

New report includes sales data for more than two dozen different accessory products.

The accessory category, which includes a wide variety of small goods that complement all musical instruments and audio products, enjoyed strong results in 2024. The estimated retail value of Accessory products shipped to the specialized m.i. distribution channel and sold direct to consumer by manufacturers advanced to a record level from the previous year. In this detailed report… ...

Thalia Capos Retools For Medical Gear

With experience in the medical device field, founder Chris Bradley puts his shop into service for pandemic fight.

Bay Area accessories maker Thalia Capos is retooling to build a simple but potentially life-saving device to help medical teams caring for critical COVID-19 patients. In addition...

Complete Music Industry Sales Report: 2025 Edition

Find detailed sales statistics on all music and sound equipment: 55 different categories, average unit prices, sales by price point, unit volume, retail and wholesale margins, year-to-date, and 10-year historical data.

The State of the Online Retail Marketplace: 2024 Edition

The top 50 online music retailers worldwide, ranked by revenues – plus contact information, base country, employee count, products carried, and year-to-year trends.

Five years of data included.

COMPLETE DATA

TOP 100 SUPPLIERS REPORT

TOP 100 SUPPLIERS REPORT

The 100 leading U.S. music companies ranked by the most recent full-year revenues. Also included: employee count and chief executive for each ranked company, plus complete analysis. Excel version includes company contact information and ten years of data.

TOP 200 RETAILERS REPORT

TOP 200 RETAILERS REPORT

The 200 leading U.S. music retailers ranked by the most recent full-year revenues. Also included: employee and store counts, productivity statistics, products carried, and year-to-year trends – plus complete analysis. Excel version includes company contact information and five years of data.

GLOBAL 225 REPORT

GLOBAL 225 REPORT

This two-part report includes: 1) A list of the leading 225 music companies around the world, ranked by the most recent full year revenues – plus employee count, CEO, base country, and web address for each. 2) Basic sales and demographic data on 47 countries where music products are sold. Includes complete analysis. Excel version includes two years of country data and five years of company data.

MUSIC INDUSTRY CENSUS REPORT

MUSIC INDUSTRY CENSUS REPORT

Comprehensive U.S. data on 55 product categories across the music products industry. Find ten years of figures showing sales by unit volume, wholesale and retail value, average unit price, and year-to-year trends. A complete analysis is included.

BUY ALL FOUR

BUY ALL FOUR

The best price on Music Trades' four most popular reports: the Music Industry Census, Top 100 Suppliers Report, Top 200 Retailers Report, and Top 225 Global Report

INTERNATIONAL DEALER SALES REPORT

INTERNATIONAL DEALER SALES REPORT

Find sales and company data – including revenues plus employee and location counts – for 327 leading retailers in 58 countries where music products are sold. Includes complete analysis and company profiles on standout retailers around the world. Excel version includes contact information and market data by country.

QUARTERLY RETAIL SALES REPORT

QUARTERLY RETAIL SALES REPORT

A snapshot of the latest U.S. sales in 15 music products categories, plus regional data, analysis, and trends going back eight quarters.

IMPORT TRACKER

The most recent quarter's import figures for key music products categories by product type, price point, and country of origin, plus year-to-year trends and analysis.

THE STATE OF THE ONLINE RETAIL MARKETPLACE

The top 50 online music retailers worldwide, ranked by revenues – plus contact information, base country, employee count, products carried, and year-to-year trends. Three years of data included.

2024 ACCESSORY MARKET ANALYSIS

This all-new report presents three years of data on U.S. retail and wholesale volumes for all key musical instrument and audio accessories that collectively accounted for over $1.2 billion in retail sales in 2023.

The leading SOURCE OF DATA & ANALYSIS SINCE 1890

© 2018 Music Trades Corporation. All Rights Reserved

Contact Us

Contact Us

BUY ALL FOUR

BUY ALL FOUR